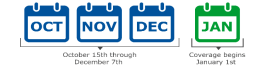

It’s the time of year to begin thinking about Medicare Open Enrollment. Open enrollment runs from October 15 – December 7, with coverage beginning January 1. This is the time of year when you should review your Medicare prescription drug coverage and make changes if your current plan no longer meets your needs or if you could lower your out-of-pocket expenses.

During your appointment we will make sure all your prescription medications are on the plan formulary in 2023, and that your pharmacy is still in the plan network. Costs such as deductibles and copays can change from year to year. Using the plan finder, we can identify whether your current plan will best meet your needs for 2023 and compare it to other options that are available. The goal is to make sure you understand how your plan works and to make an informed decision.

The extension office will be helping beneficiaries with comparison, selection and enrollment in drug plans again this year. Email Brenda at bklangdon@ksu.edu or call 785-346-2521 to schedule an appointment. Brenda will be scheduling appointments in all five counties in the Post Rock District (Osborne, Smith, Jewell, Mitchell and Lincoln).

By: Brenda Langdon

If you want beautiful, colorful tulips in the spring, now is the time to plant the bulbs! Spring flowering bulbs are often one of the first signs of spring in the landscape and a wonderful addition to any flower bed.

If you want beautiful, colorful tulips in the spring, now is the time to plant the bulbs! Spring flowering bulbs are often one of the first signs of spring in the landscape and a wonderful addition to any flower bed. The U.S. Federal Trade Commission recently found that 1 in 5 Americans have an error on at least one of their credit reports. Having an error on a credit report is not the problem for most people, but leaving it there can be.

The U.S. Federal Trade Commission recently found that 1 in 5 Americans have an error on at least one of their credit reports. Having an error on a credit report is not the problem for most people, but leaving it there can be. tool in the kitchen.

tool in the kitchen.

planning and then use that knowledge to plan for next year. One way to assess your progress since January is to compare how much debt you owed at the beginning of the year to now. Do you owe more or less overall? Another is to compare your net worth (assets minus liabilities). Are you worth more now than you were at the first of the year?

planning and then use that knowledge to plan for next year. One way to assess your progress since January is to compare how much debt you owed at the beginning of the year to now. Do you owe more or less overall? Another is to compare your net worth (assets minus liabilities). Are you worth more now than you were at the first of the year?